Africa’s booming technology scene now counts more than 400 tech hubs that range from software engineering to mobile money to blockchain technology, with at least one active tech hub in almost every country, according to the GSM Association, the trade body for mobile network operators worldwide.

The association’s Tech Hubs Landscape report, published in March, show investment in tech start-ups across the continent topped $195 million in 2017 and the number of funded start-ups up by 8.9 percent. Total funding of African tech ventures grew by 53 percent in 2017 compared to 2016, taking investment into African start-ups to an all-time high.

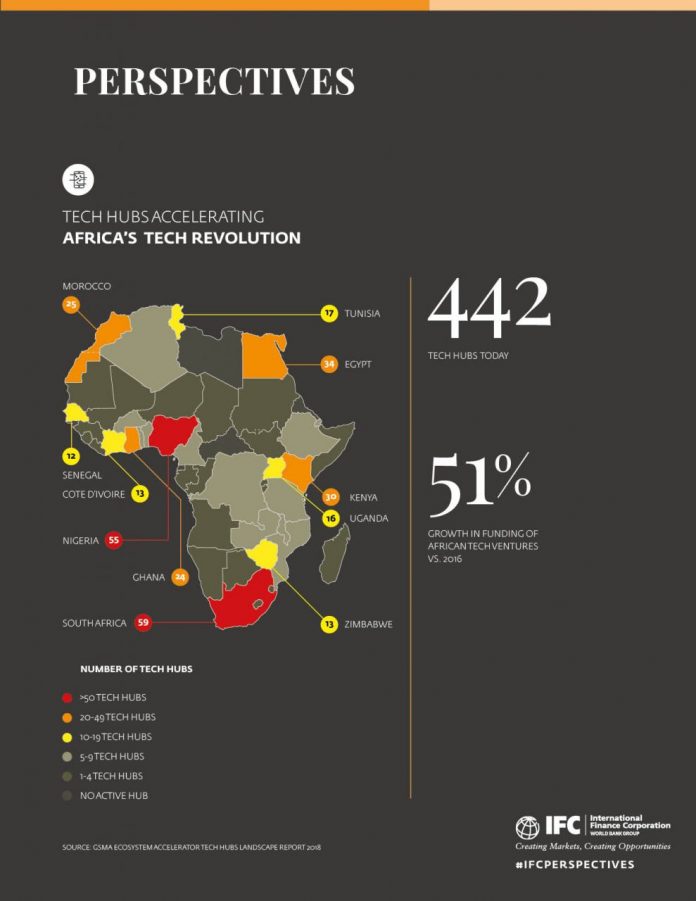

A significant contributing factor has been the proliferation of tech hubs (incubators, accelerators, co-working spaces, fab labs, makerspaces, hackerspaces, and other innovation centers) in major urban centers such as Nairobi, Kenya; Lagos, Nigeria; and Johannesburg, South Africa. Whereas in 2015 there were fewer than 120 hubs in Africa, as of March this year the number of active tech hubs continent-wide had risen to 442, with a dozen more reportedly set to be launched by year-end.

“In countries where the business infrastructure is often inadequate, these hubs represent a point of reference for local and international innovators,” says Dario Giuliani, co-author of the GSMA report.

In 2017, 45 percent of the active tech hubs were concentrated in South Africa, Kenya, Nigeria, Egypt, and Morocco. South Africa led with 59 active hubs, followed by Nigeria (55), Egypt (33), and Kenya (31). While Lagos, Nairobi, and Cape Town, South Africa, have emerged as internationally recognized technology centers, other cities are seeing significant growth in the number of active tech hubs since 2016. In West Africa, Ghana, home to hubs such as MEST and iSpace, saw 50 percent growth (from 16 to 24), the GSMA reports, and Abidjan in Cote d’Ivoire, which has positioned itself as the new catalyst of innovation across Francophone Africa, saw its number of active tech hubs double. Zimbabwe (13) and Uganda (16) led the way in “tier 2” tech ecosystems in Southern and East Africa, respectively.

Specialization, or niche focusing, is a new trend. Examples include Rise in Cape Town, a physical and virtual community that facilitates collaboration and fintech innovation funded by Barclays Africa Group; Nairobi-based Merck Accelerator, which supports health-tech ventures; and BitHubin in Kenya, which focuses only on blockchain technologies.

“Many tech hubs, having once been sector-agnostic, are narrowing their offering to target specific niches,” Giuliani says. “We’re now seeing a lot of hubs that focus exclusively on fintech, and some that focus exclusively on agritech.”

Another trend is the rise of tech giants’ interest in African markets. CEOs, including Mark Zuckerberg (Facebook), Sundar Pichai (Google), and Jack Ma (Alibaba), visited major hubs from Lagos to Nairobi; corporate partnerships mushroomed; and players, including Amazon and Alibaba increased their presence all across the continent.

A third trend shows established mobile operators launching their own incubation, acceleration or co-working spaces, such as MTN in-house incubators Y’ello Startups, launched in 2017 in Côte d’Ivoire and Congo. Indeed, MTN, Vodacom, and Orange appear as the most active operators in Africa when it comes to running or engaging with local tech hubs. GSMA says about 12 percent of the active hubs in Africa are either run or backed by a local mobile operator.